During 2008 and 2009, some claimed that diversification of stock investments is no longer beneficial, and, consequently, that we should look elsewhere to reduce our investment risks. This article assesses these claims, and demonstrates, through analysis, the benefits of diversification, even in the face of the 2008 decline. More specifically, it will discuss the potential benefit of adding small, international and emerging markets stocks, to help diversify the typical US centric portfolio.

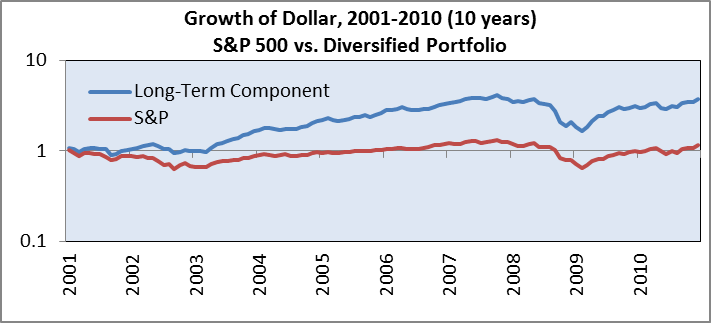

What seemed wrong with Stock Diversification in 2008? During the market decline of 2008 all stock classes declined substantially. Adding small, international and emerging markets stocks, not only did not help a U.S. centric portfolio, but even aggravated the decline, leading to a lower bottom. This can be seen in the graph below, comparing the globally diversified portfolio Long-Term Component with the S&P 500 in 2008-2009.

This result may lead you to believe that stock diversification failed.

If you redeemed your entire investment after these two years, stock diversification would not have helped you. However, a two-year investment should not be put into any stock portfolio.

Appropriate usages of stock investments include:

- Long-Term Growth

- Immediate retirement income, as long as withdrawals are limited to a small percentage every year1.

Contrary to Some Claims, Global Diversification of Stocks was Successful . If we expand the period of comparison by two additional years, starting in 2006, we get improved results, thanks to higher returns surrounding the decline. Diversification provided substantially improved security, flipping the total returns to positive, with a total difference of 24%.

If we further expand the comparison to the 10 years 2001-2010, we get a striking difference greater than 200%.

While the correlation between the portfolios seems relatively high, the diversified portfolio provided substantially better results. Two factors helped, as can be seen in the graph above:

- In early 2002 there were several months in which the diversified portfolio gained, while S&P 500 declined. These few months were enough to have the diversified portfolio recover from the early 2000’s recession very quickly and have a lasting impact until today.

- In 2003-2007 the diversified portfolio had faster overall growth, providing a result 3 times larger (200% higher) than the S&P 500. So, while the S&P 500 stayed at levels below the level of 10 years ago for a long period, the diversified portfolio maintained nice gains throughout the entire 2008 decline.

To judge whether diversification is beneficial, we should do two things:

- Compare the length of declines, in addition to the depth. In the middle graph (4 years), you can see that, thanks to the higher 2009 returns, the recovery above the 2006 level occurred many months earlier.

- Expect diversification to provide some moderation or shortening of declines, but not eliminate severe declines altogether. Given that diversifying a U.S. Large centric stock portfolio does not hurt the long-term returns (it actually increases them), it would make sense to diversify even without any risk-reduction benefit. Not only is there a risk reduction benefit, it occurs in most declines and tends to be substantial.

To further demonstrate the benefits of stock diversification, a table is provided, comparing the diversified stock portfolio to the S&P 500 over different horizons, all relevant for a retiree looking for current income:

| Annual Returns: S&P 500 vs. Diversified Stock Portfolio (Long-Term Component) | ||||

| Calendar | Years | S&P 500 | Long-Term Component | Annual Benefit |

| 2007-2009 | 3 | -5.6% | -2.2% | +3.4% |

| 2005-2009 | 5 | 0.4% | 7.7% | +7.3% |

| 2001-2010 | 10 | 1.4% | 14.3% | +12.4% |

Summary

Despite claims to the contrary, stock diversification still holds, and is beneficial through declines, including the great 2008 decline. Diversification may help shorten tough declines and/or make them shallower. In some cases, the benefit appears before and/or after the decline, still providing a great benefit to the long-term investor as well as the retiree that depends on current income.

1 3%-4% is a common range, depending on the portfolio

Disclosures Including Backtested Performance Data