Quiz!

What is the impact of Apple’s share buybacks on its P/E, and should you adjust for it?

- The share buybacks lowered Apple’s P/E in the past 3 years. At this rate, Apple’s cash will be gone in less than 3 years. Since this is not sustainable, you should adjust for it.

- Apple is a highly profitable company with desirable products. Its profits should keep generating cash to support share buybacks for the long run. There is no need for adjustments.

Should I buy or sell Apple Stock?

Apple is a very successful company, with strong demand for their products. As an investment, I see conflicting messages in their financials:

- The Price/Earnings (P/E) of 21 is not extremely high (https://www.macrotrends.net/stocks/charts/AAPL/apple/pe-ratio).

- The Price/Book (P/B) of 41 is stratospheric, about x20 higher than the average for the S&P 500 (https://www.macrotrends.net/stocks/charts/AAPL/apple/price-book).

The problem? Apple did massive share buybacks, reducing its cash on hand by 55% within about 3 years (https://www.macrotrends.net/stocks/charts/AAPL/apple/cash-on-hand). Share buybacks reduce the number of shares, increasing the earnings per share, and lowering the P/E. At the current rate, Apple’s excess cash will go down to $0 in less than 3 years. Assuming continued success, with no change in earnings growth, something has to give within the next 3 years: a drop in the stock price, or a big increase in the P/E, resolving some of the current anomaly.

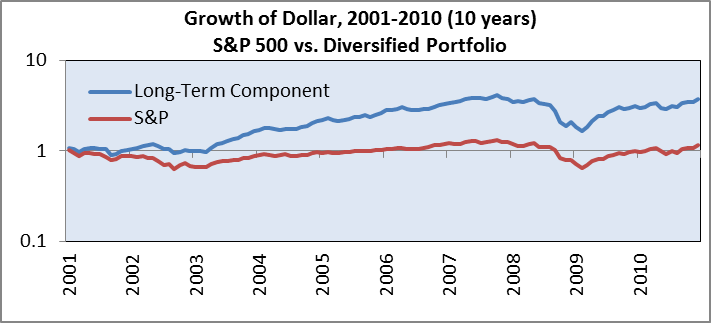

The solution? You can estimate the annual impact of share buybacks on Apple’s P/E in the past 3 years, and adjust for it, as part of a full analysis of the stock. QAM focuses on value investing based on the more reliable, stable and thoroughly studied P/B, and diversifies stock portfolios into 1,000s of stocks.

Quiz Answer:

What is the impact of Apple’s share buybacks on its P/E, and should you adjust for it?

- The share buybacks lowered Apple’s P/E in the past 3 years. At this rate, Apple’s cash will be gone in less than 3 years. Since this is not sustainable, you should adjust for it. [Correct Answer]

- Apple is a highly profitable company with desirable products. Its profits should keep generating cash to support share buybacks for the long run. There is no need for adjustments.

Explanations:

- Please read this month’s article above for an explanation of this point.

- While Apple is profitable, a realistic valuation should reflect a sustainable future, including a stable level of cash. With cash dropping fast in recent years, an adjustment is needed.