Quiz!

What are the benefits of high investments in a diversified stock portfolio relative to withdrawals? (Multiple answers may be correct)

- They help get freedom from work.

- They add to your cash reserves, dollar for dollar.

- You can count a small portion of them as part of your cash reserves.

- They provide a potential snowball of accelerated increase in your wealth.

A Strategy to Increase your Investment Growth without Sacrificing Security

In a perfect world, you would allocate all of your money to high growth investments, to maximize the speed of building wealth. The issue is that growth comes with volatility, and you may need your money during a big decline for your investments. Examples for needs are a loss of job, a downturn for your business, buying a house, and the biggest of all – retirement. Common solutions involve a money market account, bonds and other low-volatility investments, that come with lower growth.

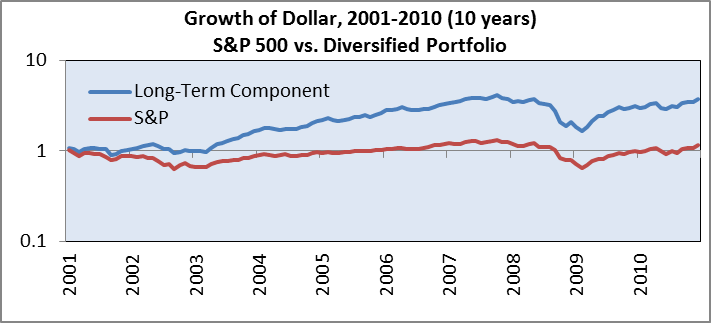

Is there a better solution? It turns out that there is another solution that lessens the compromises – a low withdrawal rate from a diversified stock portfolio. A diversified stock portfolio with a low withdrawal rate of 3%-4% may grow faster than cash or bonds when subject to the same withdrawal rate.

How do you get there?

- Build stable reserves to survive tough situations that are out of your control.

- Beyond that, invest in a diversified stock portfolio.

- Using a likely sustainable withdrawal from the stock portfolio (typically 3%-4%), reduce your reserves by that amount, moving it into the stock portfolio. You can check periodically (e.g. quarterly), and move the money whenever your investments grow relative to your spending (through any combination of new savings and investment growth).

This strategy creates a positive snowball: The more you have in stock investments, the more you can shift from the reserves to them. This accelerates the growth of your money, which allows to move more from your reserves to stocks.

Depending on how early you start, and how flexible you are with your spending, you may be able to reach 100% allocation to stocks before retirement, allowing you to sustain it for life. This can result in some combination of:

- Growing security (the fixed dollar withdrawal becomes a decreasing percent from a larger pot).

- Higher available spending (keeping the same withdrawal rate = a higher dollar amount, as the portfolio grows).

What is the catch? There are several catches:

- You have to stay perfectly disciplined with your strategy. It is tempting to sell low or put new savings elsewhere, when the news is grim. This can revert the entire long-term benefit.

- The plan is designed to allow selling a likely sustained portion (e.g. 3%-4% per year) for spending needs. This is fine as long as the needs have nothing to do with the investment performance. You may be tempted to sell low, to invest elsewhere. This is not a spending need, and if you are tempted to do that at low points, you are better off seeking a different plan in the first place.

- You may underestimate the needed reserves, or simply be surprised by something unplanned. As long as it comes at a normal point for the stock portfolio, there is no problem. But, it can hurt you during deep declines. Try to be realistic.

Quiz Answer:

What are the benefits of high investments in a diversified stock portfolio relative to withdrawals? (Multiple answers may be correct)

- They help get freedom from work. [Correct Answer]

- They add to your cash reserves, dollar for dollar.

- You can count a small portion of them as part of your cash reserves. [Correct Answer]

- They provide a potential snowball of accelerated increase in your wealth. [Correct Answer]

Explanation:

- They can cover your expenses while not working. If they are big enough, the investment growth/income can support long periods without work.

- Investments can be volatile, so you cannot assume that the full amount will be available for you at any point.

- You can count a likely sustainable withdrawal rate (typically 3%-4%) as part of your reserves, since that amount is likely to be there for you even during deep declines. Read this month’s article to learn more.

- Investments tend to grow by some percent on average. As the investments grow, a fixed percentage of larger pots becomes a large amount.